The Unbundling of Ad Cash Flow: How Tokenization is Creating a New Asset Class

A deep dive into how blockchain tokenization fixes the core problems of the digital advertising ecosystem. We explore how turning future ad revenue into a tradable asset provides instant, non-dilutive capital for publishers and creates a powerful new alternative asset class for investors.

Advertisers spent $734 billion on digital advertising in 2024, yet the publishers who produce the content that makes this ecosystem valuable are stuck waiting months to get paid, with no control over the unpredictable nature of ad revenue, driven by factors like volatile algorithm changes that can wipe out earnings overnight.

But what if this dynamic could be fundamentally redrawn?

What if you, as a publisher, could turn next quarter's ad earnings into upfront capital today?

And what if you, as an investor, could buy a piece of the success of your favorite digital media outlet or app?

This isn't a hypothetical scenario. Thanks to blockchain and tokenization, it’s now possible to convert future ad income into liquid, tradable financial assets—unlocking capital for publishers and a new asset class for investors.

What is Tokenization? A Simple Explanation

To understand how this is possible, we first need to look at the core technology making it happen: tokenization.

At its heart, tokenization is the process of creating a unique, verifiable digital representation of an asset on a secure, shared digital ledger known as a blockchain. This process converts the rights to an asset—whether physical or digital—into a digital "token" that can be owned, managed, and traded.

Tokenization is turning ownership into code.

The tokenization market exploded 85% in 2024 to reach $15.2 billion, and experts predict it will hit $50 billion in 2025. Why? Because tokenization solves a fundamental problem: making valuable assets easy to own, trade, and access.

The magic happens on blockchain - a digital ledger that's like a shared, tamper-proof Google Sheet that everyone can see but no one can fake. When you own a token, that ownership is permanently recorded and instantly verifiable by anyone.

In essence, tokenization doesn't just create a digital copy of something; it creates a native digital asset where ownership is programmable and transferable, unlocking new possibilities for liquidity and fractional ownership that were previously not possible.

The Problem: A System of Delays and Locked Doors

There’s a quiet crisis brewing for publishers who monetize through advertising—one that’s pushing publishers to the brink and stalling innovation across the board. It’s not flashy, but it’s foundational: payment delays.

For Publishers: The Cash Flow Crunch and Growth Ceiling

While the world of digital advertising continues to grow, many publishers are finding themselves stuck—caught in a system where they’re generating revenue but can’t access it for months. That’s not just inconvenient—it’s a serious cash flow crisis. And it’s only getting worse.

The Waiting Game Just Got Longer

If you’re in publishing, you’re probably familiar with Net 30, 60, or 90 payment terms. That’s already tough—waiting one to three months after invoicing to see any cash.

But according to recent reporting by Digiday, some publishers are now seeing payment timelines stretch to 120 days—or even 180 days. That’s six months of waiting for money you’ve already earned.

“Cash is king and advertisers are taking a really long time to pay us. It sucks,” said one publisher interviewed by Digiday.

These aren’t edge cases. This is becoming the new normal. And for smaller publishers or indie operators, this delay can mean not being able to pay freelancers, launch new initiatives, or even cover basic operating costs.

Revenue ≠ Cash Flow

Here’s the core issue: revenue might look strong on paper, but if the cash isn’t in the bank, it doesn’t help you grow—or even survive.

Many digital publishers are forced to operate in “survival mode,” unable to hire, scale content, or experiment with marketing because their income is tied up in accounts receivable. Some are turning to short-term loans or revenue-based financing, which only adds to the pressure.

Uncertainty Is the Only Constant

Even if publishers could plan around these delays, there's another problem: unpredictability.

- Algorithm Chaos: One tweak to Google’s search ranking or Meta’s content algorithm can cause traffic to drop off a cliff—sometimes overnight.

Sites have reported losing up to 95% of their traffic from a single algorithm change. With the rise of AI-generated answers in search (Google’s “AI Overviews”), some estimate a $2 billion hit to publisher revenue as traffic is diverted away from their content.

Ad Spend Fluctuates: Overall, the ad market is growing, yes—but predicting who gets what slice is messy.

“Overall trends in ad spend, I 100% trust what they say,” said one reddit user. “But if you’re asking for shifts from publisher to publisher, or channel to channel? I’d doubt any model can do that really well.”

The Open Market Doesn’t Care

This all adds up to a cold reality: an open market will find your price—and you might not like it. Publishers are price takers, not price setters, in an ecosystem where ad tech platforms, economic forces, and algorithms hold the cards.

That’s a tough spot for anyone trying to build a sustainable business model using ads.

For Investors: A Trillion-Dollar Market Behind a Locked Door

While publishers are battling late payments and unpredictable revenue, a completely different—but equally equally significant missed opportunity— exists on the other side of the equation:

A massive, high-growth market is effectively off-limits to most investors.

Quantifying the Opportunity

Let’s talk numbers. The global digital advertising market is not just big—it’s booming. According to industry data, here’s how it looks:

Global Digital Advertising Market Growth

Market size progression from 2024 to 2029

This data shows a market poised to nearly double in just five years, presenting a compelling opportunity for investors seeking growth.

Yes, that’s right—$1.42 trillion projected by 2029. That kind of scale is typically irresistible to investors.

Durable trends like online shopping, streaming, and creator-led content are fueling this growth. Whether it’s TikTok ads, newsletter sponsorships, or connected TV (CTV) spots, money continues to flood into digital channels. It's one of the most vibrant, resilient sectors in the global economy.

The Accessibility Gap: A Market Investors Can’t Touch

And yet—despite the scale and momentum—this massive asset class remains locked within a complex, layered ecosystem. Today, if an investor wants to back a fast-growing digital media brand, they have no direct path. That ad revenue is captured and controlled by the platforms that serve the ads, the large agencies that broker the deals, and the established media corporations that dominate the market. The value flows through these intermediaries, far from the reach of an individual investor.

Meanwhile, individual publishers—newsletters, niche content creators, indie media startups—generate real revenue, build loyal audiences, and create tangible value. But there's no clean way for an investor to participate in that success.

You can buy Google stock.

You can’t buy a slice of your favorite YouTuber’s ad revenue.

This creates a weird market mismatch: capital wants in, but there’s no door.

A Huge, Untapped Opportunity

This is more than a frustration—it’s a structural inefficiency. On one side, you've got:

- Publishers with strong demand and revenue streams but delayed cash flow

- Creators looking to grow but stuck without financial infrastructure

On the other, you’ve got:

- Investors actively seeking exposure to the digital economy

- Capital looking for yield in an increasingly competitive environment

Yet there’s no system that connects the two. It’s a classic case of demand meeting friction.

The TokenClick Solution: The "How"

TokenClick applies the powerful concept of tokenization directly to future ad cash flow streams, creating a new marketplace that solves the core problems of both publishers and investors. It builds the bridge that has been missing between publisher-generated value and aligned investment capital.

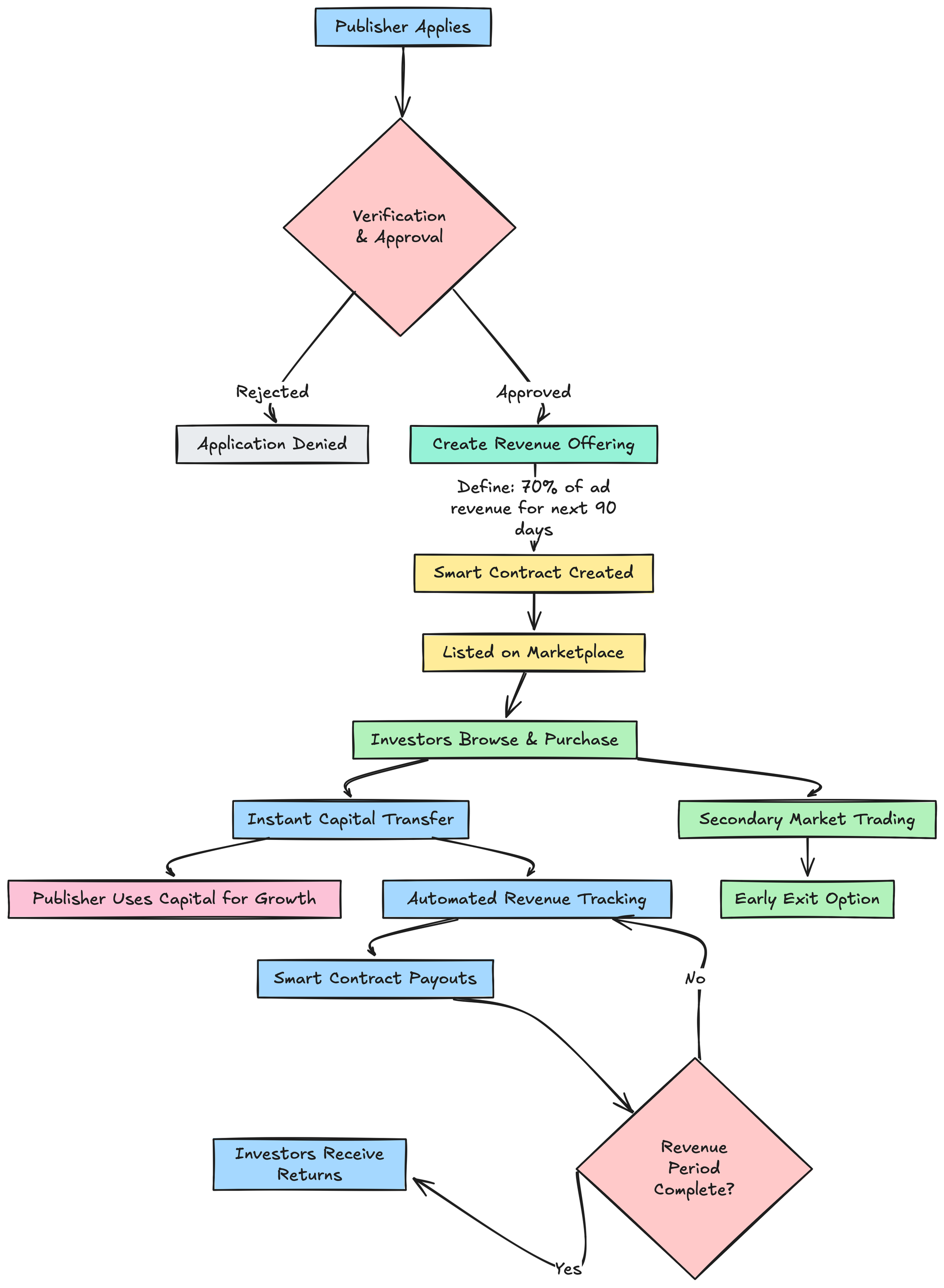

1. Publisher Onboarding & Verification

Publishers with a history of consistent ad revenue apply to join the TokenClick platform. Our system verifies:

- Traffic sources and performance trends

- Historical ad revenue consistency

- Platform and audience risk profiles

Only qualified publishers are accepted to ensure a high-integrity marketplace for investors.

2. Tokenization of Future Revenue

Once onboarded, publishers define a future revenue stream they’d like to tokenize—such as 70% of their ad income over the next 90 days. TokenClick then mints digital tokens that represent contractual rights to that future revenue stream. These tokens are built on secure, auditable smart contracts.

3. Launch on the Investor Marketplace

The tokenized offering is listed on TokenClick’s marketplace. Each listing includes:

- Verified publisher performance data

- Terms of the offering (duration, revenue share, yield profile, sale type)

- Risk factors and forward-looking estimates

Investors can review offerings and purchase tokens using either fiat or stablecoins.

4. Instant Capital, Non-Dilutive

Once an offering is fully funded, capital is instantly transferred to the publisher’s account. This is:

- Debt-free: No interest payments

- Non-dilutive: No equity given up

- Immediate: No waiting 30, 60, or 90 days

Publishers use the capital to grow—hiring, launching new content verticals, investing in marketing, or expanding their teams.

5. Automated, Transparent Revenue Payouts

As the publisher earns ad revenue, TokenClick monitors the income and enforces payouts to the smart contracts vault.

- Payments are automated and real-time

- Investors claim their proportional share by redeeming their ad tokens

- Revenue transparency is built into the system

No paperwork, no payment delays, and no risk of missed invoices.

6. Liquidity Through a Secondary Market

Investors don’t need to wait for the full term to realize returns. TokenClick offers a built-in secondary market, where these Ad Tokens can be freely traded.

This adds:

- Liquidity to what was previously a locked-up asset

- Flexibility for investors who want to exit early

- Market pricing that reflects real-time demand and risk

The Power of Transparency: On-Chain Performance Metrics

TokenClick brings transparency by tracking how many impressions tokenized inventory generates and the revenue it earns — all aggregated to protect transaction privacy. Instead of intermediaries paying publishers directly, revenue flow through a smart contract on the blockchain, making payouts verifiable and trust-minimized.

This approach uses validity proofs to enable independent audit and reconciliation without exposing sensitive data. By aggregating impression and revenue data securely, TokenClick transforms unpredictable ad revenue into tradable Ad Futures. We’ll dive deeper into the mechanics of these validity proofs and their impact on trust minimization in upcoming posts.

Conclusion: A New Paradigm for the Digital Economy

The current digital economy is built on a fundamental flaw: the people and businesses creating value are the last to get paid. It’s a system of locked capital, where publishers wait months for revenue they've already earned and investors have no way to back the specific digital ventures they believe in.

TokenClick fixes this. We turn future ad revenue—from any digital platform—into instant, non-dilutive capital. For publishers, it’s the power to fund growth on your own terms. For investors, it's direct access to a new, performance-based asset class tied to the digital economy.

We are building the exchange where ad cash flow becomes liquid, tradable, and accessible to all.

Be the first to experience it. Join the TokenClick Pioneer Waitlist.